If you live in Pensacola, you’ve probably heard neighbors complain about sudden insurance increases. Some saw rates jump without warning, while others learned their home was moved into a new flood zone. These surprises often come from one simple issue: homeowners don’t use their flood elevation certificate to check what insurance companies assume about their property. When the numbers don’t match, the bill goes up.

Pensacola’s flood rules changed in 2025 when FEMA released new maps for Escambia County. Many homes were reclassified, and insurance companies immediately reacted. Because of that, now is the perfect time to look at your flood elevation certificate and make sure your insurance reflects your home’s true elevation—not an outdated guess.

Why Pensacola Saw Sudden Insurance Increases

FEMA’s updated maps shifted thousands of homes into different flood zones. Some homeowners moved from low-risk to moderate-risk zones without realizing it. Others were placed in areas that appear more dangerous even though nothing changed on their property.

Insurance companies rely on updated maps right away. They don’t wait for homeowners to update their paperwork. So if your flood elevation certificate uses information from before the 2025 FEMA release, your insurer might think your home sits lower than it does. That mistake leads to higher insurance premiums, even if your property is much safer than the map suggests.

This is why so many residents faced surprise increases this year.

Your Elevation, Your Map, and Your Survey Must Match

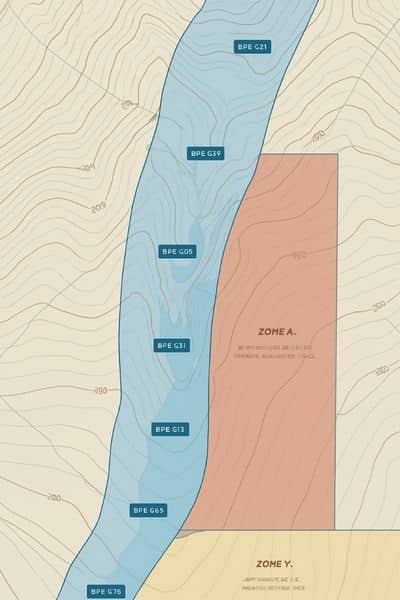

Many homeowners only check their flood zone, but that’s only part of the story. Your real risk comes from how high your house sits compared to the base flood elevation, or BFE. Your flood elevation certificate shows that number. But it only helps you when it matches:

- the 2025 FEMA flood map

- your actual ground and floor elevation

- your most recent land or site survey

If any of these pieces are out of date, your rate may be wrong.

For example, if you remodeled, added fill to the yard, or raised your A/C platform, your home’s height may be higher than your certificate shows. If the certificate doesn’t reflect those changes, your insurer treats you as if the improvements never happened. This mismatch can raise your premium fast.

Step 1: Check Your Zone on Escambia County’s Flood Viewer

A smart first step is checking your current zone on Escambia County’s flood map viewer. It shows the newest data from the 2025 FEMA update. When you enter your address, your zone appears immediately.

Now compare this zone to the one on your flood elevation certificate. If the zones don’t match, your insurer may be using outdated information. This is your chance to correct it before your next renewal.

Step 2: Compare Your Base Flood Elevation to Your Home’s Elevation

Your home’s elevation matters more than most people realize. Look at how your structure sits compared to the BFE listed on the new map.

If your home sits above the BFE, you may qualify for lower insurance rates. But the only way to prove this is with your flood elevation certificate.

If your home is below the BFE, your insurance may go up. Still, many homeowners pay more than they should because their certificate lists the wrong lowest floor or old ground elevations. In Pensacola, where many homes have raised porches or crawlspaces, even small errors affect your rating.

When something feels off, ask a local surveyor to check your numbers. A short review can find mistakes that cost you money. It also helps to slow down and get your elevation details verified, because even a small correction can make a real difference in how your rate is calculated

Step 3: Make Sure Your Certificate Matches Your Latest Site Survey

A flood elevation certificate is only accurate when the survey behind it reflects your current property. If your certificate is older than your recent improvements, the numbers may be outdated.

Pensacola neighborhoods like Gulf Breeze, East Hill, and Tiger Point vary slightly in elevation. A difference of only a few inches can change your rating. One home may sit safely above the BFE, while the house next door falls below it.

Homeowners who update their survey often discover they’ve been paying more than they should.

Step 4: Look for Red Flags That Signal Incorrect Rates

While reviewing your flood elevation certificate, check for details that often lead to incorrect insurance bills:

- Certificate created before the 2025 map update

- Home footprint changed since the last survey

- Lowest floor recorded incorrectly

- Ground elevation near the structure looks outdated

- Photos don’t match your current layout

- Insurer lists an old or incorrect flood zone

Any one of these issues may cause an unfair rate.

Real Pensacola Situations Where Elevation Changes Everything

Pensacola appears flat at first glance, but small elevation differences can impact your flood rating.

East Hill: Some streets slope toward Bayou Texar. A house sitting just six inches higher than its neighbor may avoid a mandatory rate increase.

Gulf Breeze: Homes close to the water often sit on slight rises. If your flood elevation certificate predates the 2025 FEMA maps, your insurer may assume you are lower than you are.

Ferry Pass and North Pensacola: These areas gained new moderate-risk zones. Many homeowners who updated their surveys found they were above the BFE and qualified for lower insurance.

Scenic Heights: Renovations and grading changes caused old certificates to become outdated.

In all these areas, comparing the certificate with current survey data helped homeowners correct wrong rates.

When You Should Update Your Flood Elevation Certificate

You don’t need a new certificate every year. However, you should update it if:

- your insurance suddenly increases

- your flood zone changes

- you find errors in your certificate

- you made changes to your home or yard

- your certificate predates the 2025 FEMA map update

- the elevation numbers don’t match your survey

An updated certificate often fixes unfair insurance bills.

Why Working With a Local Surveyor Helps

A local surveyor understands terrain and how small changes affect elevation. They know which yards sit slightly higher, which homes were graded, and how the 2025 FEMA maps changed the area.

They can confirm your actual elevation, update your certificate, and explain how the numbers affect your insurance. This guidance helps prevent overcharges and makes sure your insurer uses the right information.

Final Thoughts

If your insurance jumped this year, don’t assume you’re stuck with the new rate. Your flood elevation certificate may hold the answer. By comparing your certificate, your survey, and the 2025 FEMA maps, you can protect yourself from overpaying and ensure your insurer uses accurate information.

Before your next renewal, review your certificate—or ask a surveyor to review it with you. A small check today can prevent a large bill tomorrow.